The Facebook Curve

The market had a bit of a reversal on Thursday for what reason I cannot quite figure out. Maybe politics, but the economic news all week has been ok. One name that took off on the close was Facebook (FB). FB spent most of it day in the mid-26 level only to ignite on the close to close 27.25. It was like all the sellers went home. What it left at the end of the day was a really flat term structure.

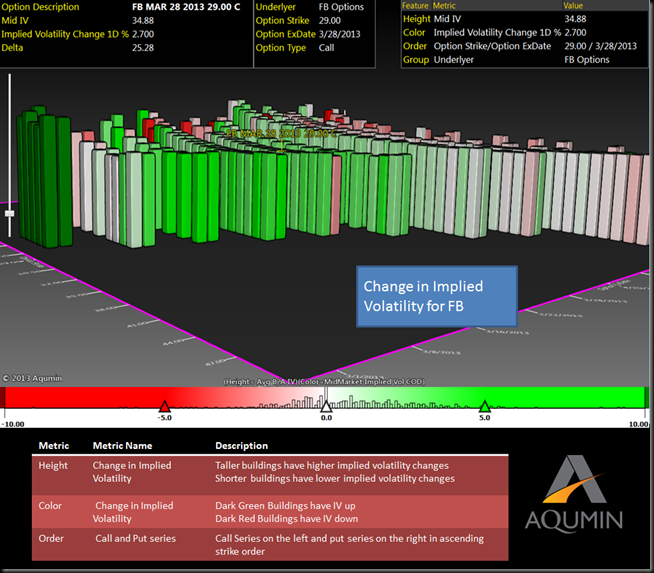

If you look in the OptionVision™ Landscape there is not a lot of variation in the implied volatility in the first 5 Weekly expiration cycles. There is almost no contango at all. Contango is just the effect of lower implied volatilities in the front month than in the back month. Normally when a stock is not doing much the IV exhibits this pattern. With the nice pop on the close, the term structure in FB is a bit different. It is dead flat until you get to the earnings cycle a bit farther out. I find this in a popular name like FB to be a bit strange. This allows a trader to buy time spreads for pretty good prices since they don’t have to sell the front month options down. The fact that there is not much contango there means an investor can use the front options to help pay for the back month options at favorable prices.

I think take the term structure at what it is and buy OTM call time spreads in the big Social Network on the cycle prior to earnings. You will end up liking that you did.

I have FB positions.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment