No one likes Facebook juice

The remarkable thing about FB as a name is it is barely in the news anymore. The lock ups are going away and the stock has become, well, very boring. It is as if the initial hype was so big that the investment bankers just want it to slowly go away until the magic number comes back into view. That number is the IPO price which the name was approaching in early part of the year 2013. The 100 billion dollar valuation is a ways away right now and it won’t be hitting it anytime soon. That does not mean it won’t be an interesting trade between now and whenever it gets back to the IPO price of $38.

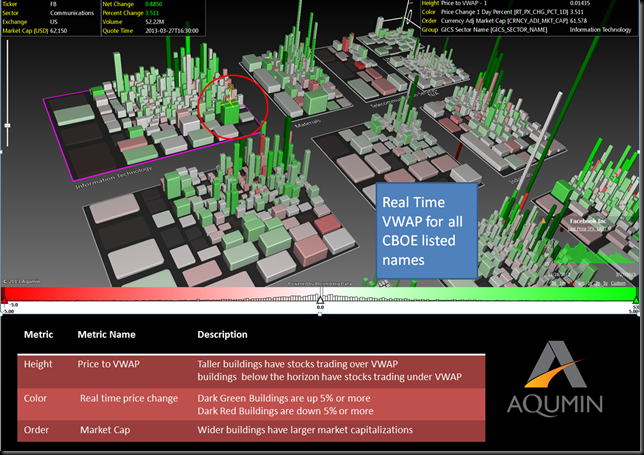

Yesterday FB was one of the few bigger cap tech names showing some real strength. The stock has been on a recent slide from $31 and change and started changing course yesterday. The momentum view below shows FB trading stronger than the other big cap (those are big blocks) names in the tech sector in AlphaVision™ for Bloomberg. You just connect AlphaVision™ to the Excel API in Bloomberg.

Yesterday FB looked like it wanted to run. But today looking at the options all of the action has cooled somewhat. I have the near term volatility dying in April as you can see below in the OptionVision™ landscape. The move we had yesterday is slowly drifting away, and with it the implied volatility in the options.

If you note the height of the buildings above, the implied volatility is much higher in the earnings cycle coming at the end of April. The Apr option implied volatility is getting to near 52 week lows and is the best way to play a little rally back to earnings. We saw a little smoke yesterday as FB rebounded and here is a chance to grab some options for better prices.

AlphaVision™ data from Bloomberg

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment