Volatility begets Volatility

I don’t quite know what happened between last Monday and today but someone with a big bottle of happy pills was doling them out like candy from a Pez dispenser. The Sequester is no problem, Italy has no choice but to follow the path, Draghi won’t lower rates and Uncle Ben won’t raise them and just like that the Dow is at an all-time high. I am of the mind that the equity markets have had mostly lower valuations for a while based on the fact that the economy cannot grow. There were 0 returns in 2011 and a nice return for 2012 but averaged out it was not that much. 2013 is giving things a kick but stocks are at nothing like crazy valuations. The big question is can growth happen, and if history serves it can if the governments can get out of the way. Somewhere between last Monday and today that point started to crystalize.

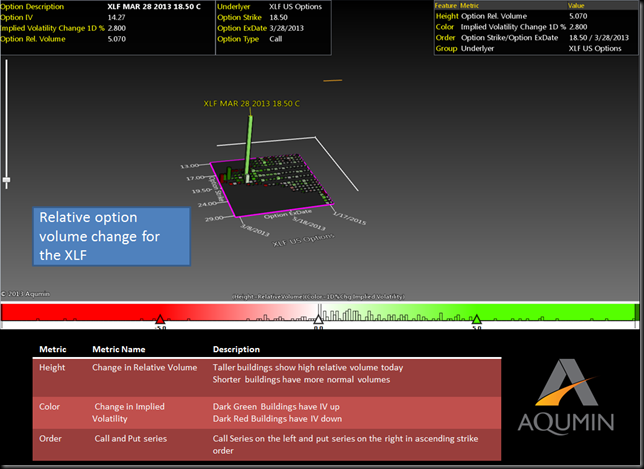

I have a snap of XLF in the morning on my Unusual Activity screen and there was a size trade going up in the XLF Mar28 Weekly 18.50 calls. Note the green hue means the volatility is going up in the strike. On the day about 100,000 calls went up and almost all were buyers.

By late in the day more buyers jumped in and the big volume was all on the call side. For the first time I can remember in a long while buyers are lifting the offers in size and buying calls in, drum roll, the bank stock ETF known as the XLF. Hard to believe and the funny thing is banks are still relatively cheap although not as cheap as they were last year when the XLF was roughly 13. Call buyers driving up the volatility, so pinch me is it 1998 again?

Beside the flip tone my early lesson in trading volatility is vol begets vol. Buyers of options can generate a head of steam and with stress tests coming out most likely loosening up bank balance sheets for the first time in half a decade a sleepy name like XLF can take off. The buyers of the 18.50 flattened the upside so I bought some Mar28 Weekly 18/18.5 call spreads for ok prices so it was not a total buy the rumor trade. I will most likely hold them long after the test results are announced today.

Option Pit will be giving a free webinar March 13 on how to use OptionVision™ to help spot order flow and build positions accordingly. Click this link to register: Option Pit "Using orderflow to trade options"

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment