Up, up and AWAY

The market took a little pause this week as it shockingly came to the conclusion that the Fed will not be able to hold rates at near 0 forever. I feel like the guy in Casablanca who was shocked, shocked that there was gambling going on in Rick’s Café. Either way a selloff is bound to happen since things cannot go up forever except of course, it would seem, our Federal Debt. I won’t get into the politics but the economy did not grow in the 4th quarter and the market did not care one bit. All anyone cared about was visibility on the government role and as of the 1st of the year they got some of that. The market likes visibility because that makes choices a bit less gnarly. Visibility comes in many ways so I thought I would change track and show a different way to view numbers.

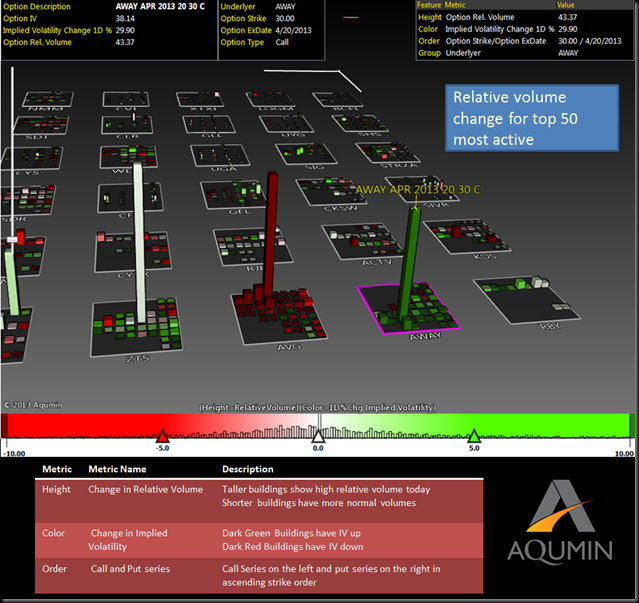

I am using OptionVision™ with the activity view. This is just relative volume (spike) and implied volatility change (color) to show what is happening today. If the SEC used OptionVision™ finding unusual activity would take all of 20 seconds. I thought this spike in AWAY looked particularly interesting today.

AWAY is a web service that helps folks find vacation rentals and related items. A giant buyer came in and bought the AWAY Apr 30 calls pushing up the IV with it. I find this interesting because AWAY just reported earnings and this kind of post earnings activity is not normal. I am positioning myself accordingly.

The nice thing about looking at vast amounts of data at once is it is near impossible to screen for every nuance with an algo. Sometimes the story just “pops out” and that is the case with AWAY.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment