Market moves sideways but the nervousness remains

Stocks are still within daily striking distance of all-time highs. Normally with so much euphoria over equity prices traders would expect volatility levels to get back below the teens. This is not so lately. The market continues to rally despite record sovereign debt loads in the G7, economic and political unrest in several emerging market economies, and tepid numbers in the US after the cold winter.

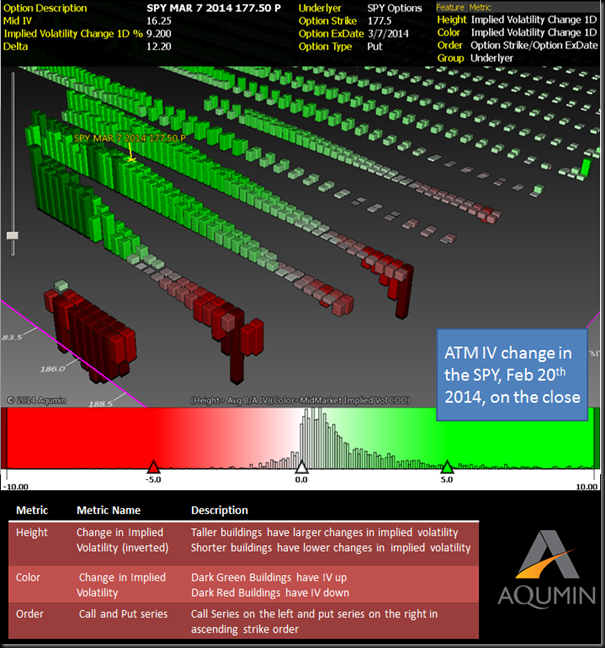

What this brew creates is sharp realized volatility in the equity markets. 2014 has been volatile and the intraday swings in the SPX are near 1% a couple of days a week at least. The curve has been constantly adjusting for this in the SPY. On the close the spy Mar 7 Weekly 177.5 puts were trading 16.25%.

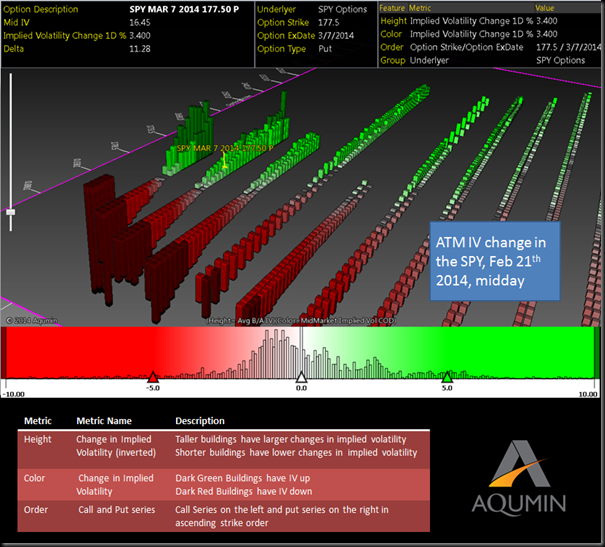

By midday today the same puts had jumped up to 16.45%. Not a big jump, but this is on a day where the ATM IV is getting whacked from the weekend effect. Net-net the curve is making a bid move up on the downside. Note how the drop in IV ATM has accelerated from yesterday.

From a trade point of view the market seems to be stuck with no great reason to rally, but not a compelling reason to sell off. The trade here could be selling short term Iron Condors closer to the ATM of short duration in the big indexes. Try to look for spreads where the skew is the most bid and leave them on for a few days only.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment