Where are the gold bugs?

Aside from stocks starting to tip back to all-time highs, the other surprise long trade for 2014 is gold. With tax selling and every big name fund giving up on hyperinflation, gold had a rough 2013. For 2014 the metal is making a big move after trading under $1200 just into the last week of 2013. Gold is busting through $1300 and for now there seems no stopping it.

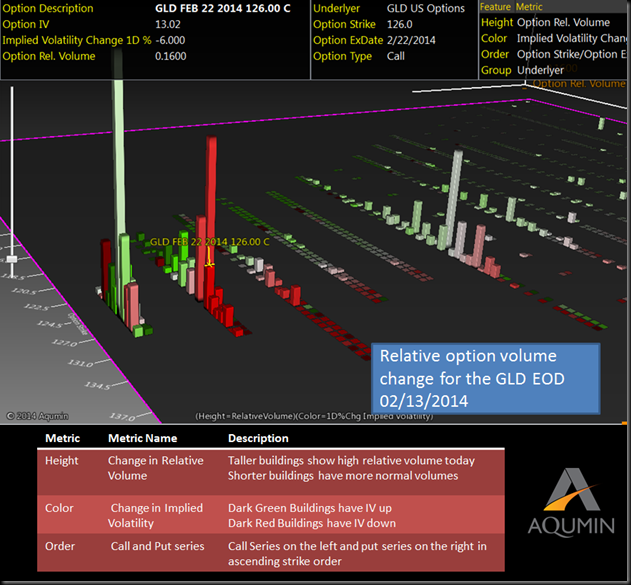

Normally a good jump in gold prices gets some interest flowing from the retail community. Not so for right now. The OptionVision™ Relative Volume scale is showing volume but on declining (red is a drop in IV) volatility. Note how the call volume is not driving up the IV. Paper does not look like they are buying into the jump in gold prices for now but writing calls against long underlying positions.

I think that sets up an opportunity for a mid-term option trade. With gold moving steadily over the last two months and with no real let up, the options are cheap enough to buy. The gold bugs should get excited again as the metal notches new highs for 2014.

A decent trade idea would be to buy a ratio call spread (buying 2 and selling 1) for even money. That way if the rally does not continue, the losses will be next to nothing.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment