Withering Numbers

As we got an underwhelming number out of NFP, the market does not know what to do with itself. Stocks have traded lower for most of the day and volatility ATM has done nothing but go down. The takeaway of that is twofold- The Taper is on track with lower unemployment numbers and job creation is still spotty. That is enough to leave the status quo as is in a ball of confusion.

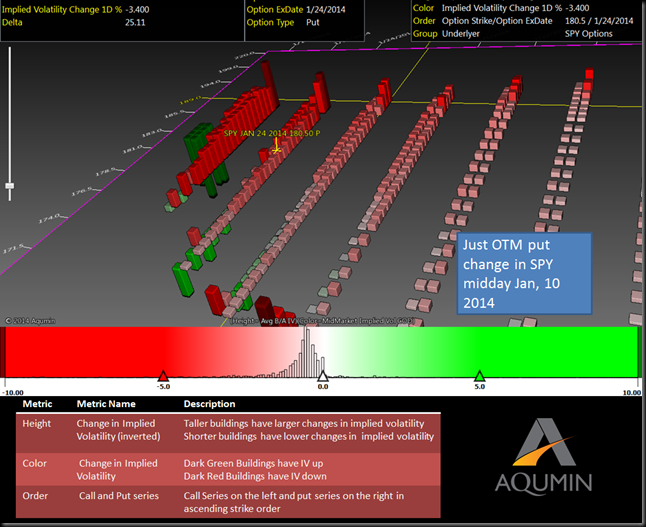

Note in my OptionVision™ landscape above that IV declined mostly ATM in the near term, but declined less as the puts got more out of the money. That is the skew responding to the decline and not quite giving up the ghost for volatility.

What I find most interesting is that the next two terms in the SPY are now trading below 10% ATM. That is not a lot of action going into earnings. It’s as if the market wrote off the current numbers in NFP and is content to do the same through the earnings cycle. We could be surprised of course, but IV almost always declines through earnings.

A smart trade would be to sell short term Iron Condors into what the market believes is limited movement. Keep at least 1 Standard Deviation from the ATM.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment