The no-Conviction Sell-Off

Happy New Year!

2014 started off with big thud. I do a radio podcast on The Options Insider Radio Network on Thursdays and there was some speculation that the selloff was from longs needing to raise money to pay taxes. All the big names got smacked a bit after posting very good 2013’s. Conversely, gold is launching probably from an end to tax loss selling. The government is still in the market….

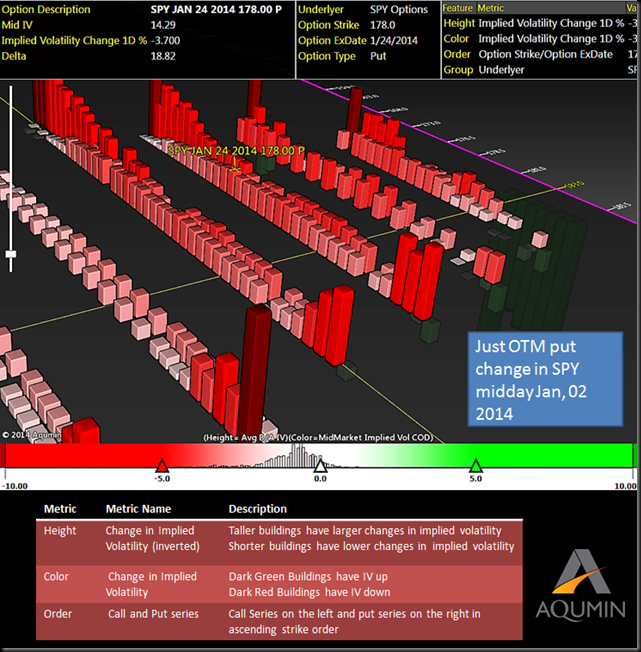

Normally in a sell-off the VIX goes up and yesterday was no exception. The volatility index is designed to climb when the market sells off. What was interesting midday is that implied volatility per strike in the SPY was going down. Below is an inverse view of the implied volatility in OptionVision™ for SPY. Note how the just out-of-the-money implied volatility declined the most.

In short, the most movement sensitive options were losing IV just as they should be gaining IV due to market uncertainty. I think this was a sign the sell-off had no real legs to it. I write this as we open only slightly higher Friday morning, but it would not surprise me if we get back a good chunk of the selloff over the next couple of days. That should tank the very near term IV.

A just OTM call time spread in the SPY owning the Jan 24 Weekly Cycle and selling the Jan 10 Weekly cycle should work right as we go into earnings.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment