Leaving the Homebuilders Behind

One of the strange observations of this past week is how much the market has gone nowhere. We closed around 142 on the SPY last Friday and we most likely will close around 142 today. The recent unemployment report was ok but has some noise in it from Sandy. The casual market observer would think not much happened. However, there are some interesting things going on…

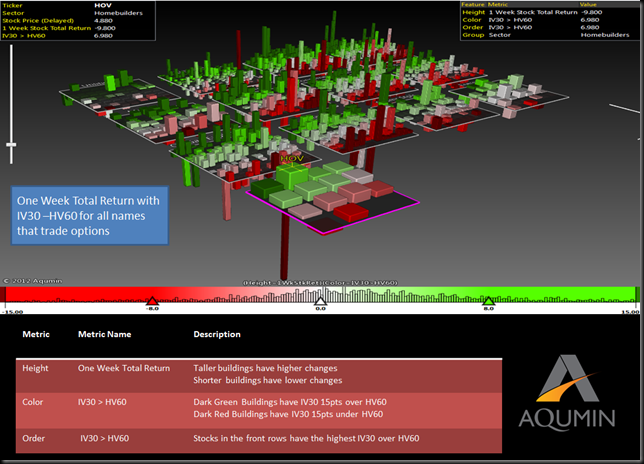

Look at the Big View landscape from OptionVision™. While there was a lot of scattered weekly activity the only real “parking lot” you see is in the homebuilder sector for 1 Week Total Return. I use the term parking lot to describe a landscape sector that has no buildings up for the week. The homebuilders did not participate in the scattered buying and were losing some momentum after their recent runup.

So, let’s flip over the landscape (below) and see what is there. HOV is a standout with the most pull back of the homebuilders. The landscape color is pretty evenly split between red and green although the green stocks are a little heavy. Color here is the IV30 trading a premium (green) to HV60. Right now IV is probably a little high over all but not too much based on current movement. I have seen this landscape 90% green before and 90% red before over the past year.

As far as the homebuilders, this is a group that most likely has some big profit taking into the end of the year as the group has performed very well this year. I expect the move up to restart as soon as everyone is done grabbing their cheapy capital gains rates for 2012. The XHB (SPDR Homebuilders Index) has seen $24 once in the last 3 months (it is up from 17.15 at the start of the year) and that is a pretty good level to sell a few puts. Eventually things might start to move again….

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment