AAPL vol is through the roof

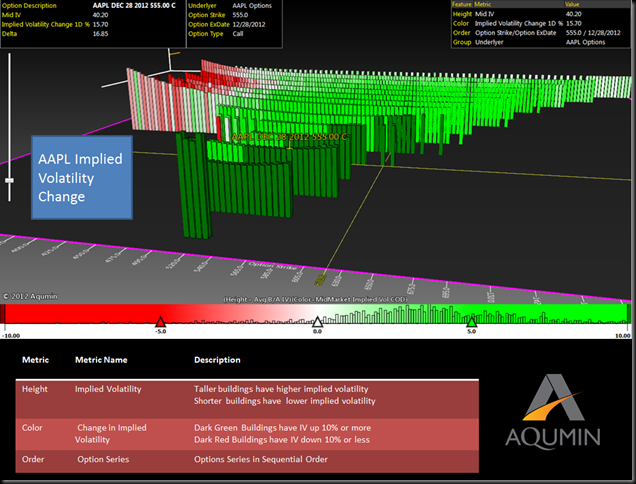

As I watch the market this morning most of the volatility is coming from AAPL. Traders still cannot get past the fact that AAPL has changed into a slightly different stock lately. 10 Day realized volatility in AAPL is hovering around the 40% level, and as of today the stock is showing no signs of giving that up. Implied volatility in AAPL, measured by the AAPL VIX (VXAPL) is up 3 full points this morning. If you want to see where all the buying is located, take a look below.

The OptionVision™ landscape helps identify how the skew is changing in AAPL. Most of the upside calls have been getting the action. The OTM calls are actually increasing in volatility faster than the OTM puts. If you look below the dark green strikes are up 10% or more. Note all of the dark green increases on the calls are pushing the skew almost parabolic on the upside.

As AAPL dances around the $512 level, buys are still bidding up calls as the legions of AAPL believers come in and play the next bounce. AAPL could well bounce and most likely will be the beneficiary of any progress on debt talks. If you must get long selling OTM put spreads (475 level) make more sense if the IV starts to cool. Take your time in entering since the stock is still moving around a bit.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment