When Volatility goes down…

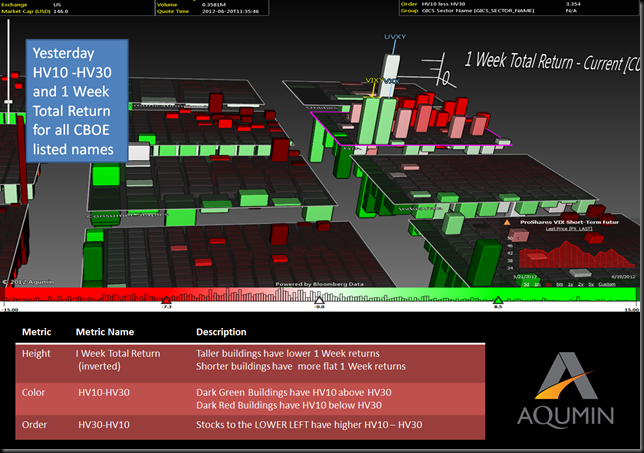

The mini-crash we had over the last month seems to be over (educated guess on my part). First, the market appears to be accepting that the Euro Area will continue to be a mess with lots of wrangling back and forth. Keeping the Euro party going is the goal. That stability is much easier for stocks to handle. Second, the US keeps muddling along with its generous fiscal policy and low interest rates. One or both of those has to change, just ask Greece. Even JPM was able to cover some of their short positions in CDS insurance. Lastly, the market crushed the volatility last week. Take a look at the AlphaVision™ volatility landscape below.

The Volatility ETN’s went down over the last week, registering some of the lowest total returns in the market of any major exchange trade product (landscape above is flipped (inverted) showing what is down). Note the light colors of both highlighted names (VXX, VIXY and UVXY) in the AlphaVision™ for Bloomberg Landscape. UVXY had a trailing 10 Day Volatility, trading about even with the 30 Day Volatility. Both the VXX and VIXY had slightly higher near term volatilities (light green) but not overly so. To me that means an orderly decline which is better for equity values short term. There is a trading rule that when the VIX breaks 25 on the upside - buy it, and when it breaks 20 on the downside - sell it. This VIX trading rule seems to be holding true since the Greek Elections. I expect it to continue.

Authors note: Trading the volatility ETN’s is very risky and requires a solid understanding of the products’ underlying characteristics. Read more from Andrew or sign up for Option Pit Live at www.OptionPit.com.

No comments:

Post a Comment