The Big Banks are moving like hot cakes

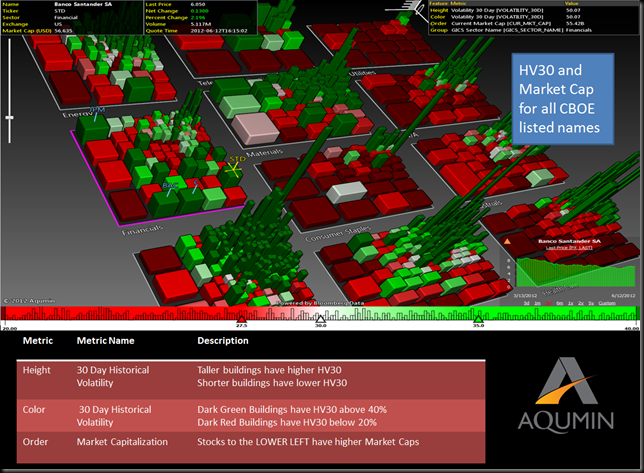

As we get into the Greek election weekend there has been plenty of up and down movement going on. The major indexes have been trading at 20%+ realized volatility, as the market trades on each bailout snippet, and finance minister squabble. The market for volatility is still looking very robust, but how long will that last? Look at the financial stocks below in my AlphaVision™ landscape view of 30 Day Realized Volatility. (This is just one of the landscapes we will be running live at SIFMA next week).

What helped turn the heat up on the Financial Sector was JPM’s trading losses. Those losses, while big, are nothing compared to the balance sheet of the company. JPM will most likely recover. The timing of that with the Greek political quagmire turned the mess into a market rout. Now the big financial stocks are swinging again. The Aqumin landscape below shows 30 Day Realized Volatility. The spiky dark green buildings are names with the most underlying volatility for each sector. In the Financials, most of the big money center banks are the most volatile right now. That usually means trouble for the rest of the equity market. The two big blocks in the front are just different classes of Berkshire Hathaway (which generally weathers financial storms well). The banks need to settle to sustain a rally in stocks (not just the flip flop we have had lately).

The Greek election will (hopefully) provide a clearer picture of whether Greece stays in the Euro or not. I don’t think the ECB and Germany can afford to have a country keep going back on debt pledges. We will see Monday. Either way the steeper underlying action for the big banks can go on indefinitely. Short time spreads (these are big margin for retail) in the banks for the OTM puts should work out when the dust starts to clear. I think the volatility will start to come in and the US banks should catch a bid since they have already survived their own financial crisis.

Read more from Andrew at Option Pit

No comments:

Post a Comment