Time Spreads for Tech

As the market settles into the new era of latent Greek issues we find ourselves looking at more banal topics like earnings, growth and the fundamental stuff. What happens is that translates to plumped up implied volatilities around earnings. The normal hum of paper betting on earnings comes back into the fold as investors start to focus on the single stock issues.

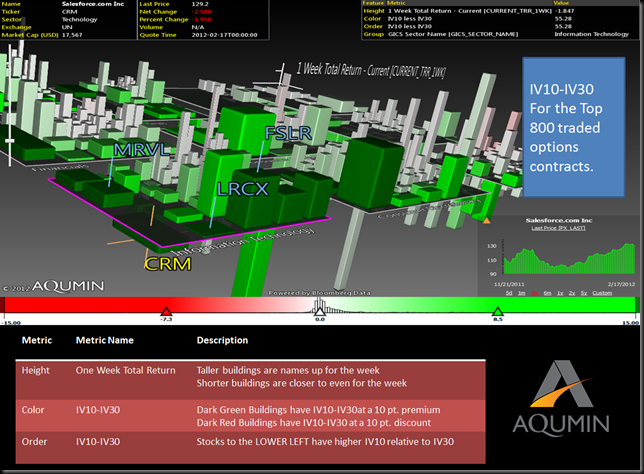

Generally higher short term volatilities means the market is expecting some kind of move. How to tell that? Simply compare the front month to the next month implied volatilities. The Aqumin Landscape construct makes that very easy to do. Take a look at the Aqumin Volatility Landscape below. This helps measure IV10 (10 Day interpolated implied volatility) and the IV30 (30 Day interpolated implied volatility). The interpolated part means the data vendor (in this case Bloomberg) is assigning a value for the smooth volatility surface. Instead of a value per strike a “volatility percentage” is produced for that many days out in the future.

What I noticeable here are lots of dark green buildings in the front corners. These are stocks with very steep front month to back month term structures. I picked up on the IT group because there are so many. Note most of the market has a flatter (read white) term structure. CRM has a 10 Day IV clocking in at 55pts over the 30 Day. That is number 1 for any IT stock as of the close Friday. CRM, like most of these green stocks, has earnings this week and it looks like the market is expecting a move. Betting on earnings is dicey at best but long term holders are getting fatter premiums for sure as the market is pricing for action. That is too much of a risk for me. Look at names that have some decent IV10-IV30 spreads that are off earnings cycle like LRCX or FSLR. The modified time spread construct (buying the 30 day and selling the 10 day) might work well in these as some of the recent movement cools.

No comments:

Post a Comment