Is Greece done with its slide?

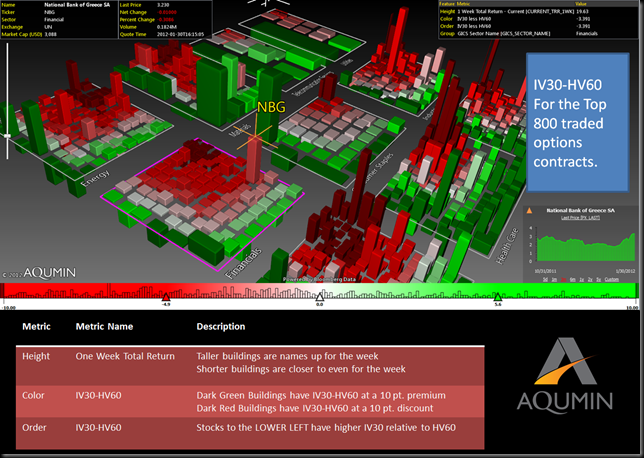

For 2012 the US equity market is up a little over 4.6% as measured by the SPY (S&P 500 ETF). After 2011 maybe the market should just stop here, call it a winner, and move on. But that is not the way it works. A quiet mover (besides AAPL of course) is the Financials. The XLF (Financial Select SPDR ETF) is up over 7% this year. Any serious market watcher knows how heavy the Financials weigh in the big indexes. For the SPY to really break out, the Financials need to help and they are finally pulling their weight. Take a look at this AlphaVision™ for Bloomberg landscape below.

I am using the IV30 less HV60 Landscape here. Building height is 1 Week Total Return. Imagine my surprise when the #1 Financial stock for the week in Total Return was….National Bank of Greece (NBG)! Also note the red color which has the forward 30 Day Implied Volatility (IV30) trading below the trailing 60 Day Historical Volatility (HV60). Readers of this newsletter would have seen this Landscape very different in mid-October; it was basically all green as the implied volatilities were bid way up due to looming Greek default. That was the landscape of impending doom (see from my Volatility Fatigue post of 10/05/2011 and the 2nd landscape below). The market outlook this morning in this landscape looks more balanced (normal) now.

Today’s more balanced IV30-HV60 Landscape.

All green IV30-HV60 Landscape of Impending Doom- Very High Implied Volatilities in early October.

No comments:

Post a Comment