When Momentum Stocks Die

As an owner of stocks I just love the blowout rally that we had on Monday. The problem of course is the 1000 point drops in the Dow Jones Industrial Average just prior to this spike. I would be happy to say the Euro Zone problems are done, I cannot just yet. It looks better on balance over the weekend as Euro TARP is on the table but the general illiquidity is still a bit of a mess. Yesterday’s closing AlphaVision™ Landscape view told an interesting story, so I thought it would be worth describing. I think we saw the death of a once great momentum stock (although it had been quite sick), Netflix.

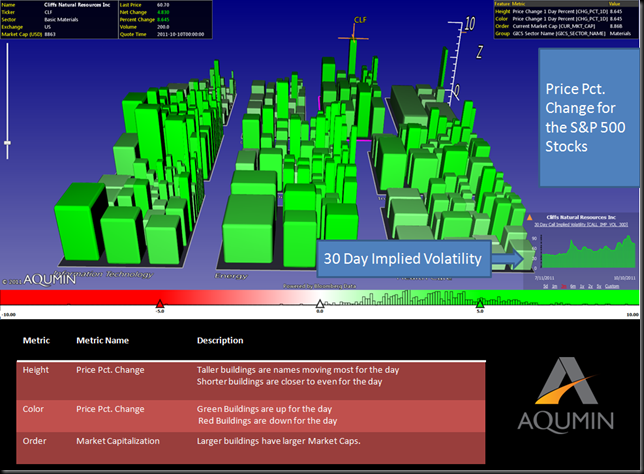

My quote screen is the view I call the AlphaVision™ Ticker (AV for Bloomberg). Height and Color are the Percent Change in Price and the Building Size is Market Cap. Also, note the chart on the lower right which is my 30 Day Implied Volatility (IV30) measure using Bloomberg Data. You can watch as many names as you want (up to 600K with the new 64 bit AlphaVision™) but here I am looking at the S&P 500. Good Euro News and “Bam!” like Emeril every stock flies. Talk about correlation. Notice that CLF was the best performer yesterday and note the volatility chart in the bottom right (Materials bottoming?). The name is peeling off of recent IV30 highs and that is the kind of momentum I want , if looking for more upward movement in the underlying. With declining IV30, the forward indicator is forecasting less movement. I read that as some of the severe downside is taken out of the mix for this Materials name.

When I taught option trading to newbie floor traders, showing opposite ends of the spectrum was always helpful. AlphaVision™ makes this easy because you just flip to the other side of the Landscape (see below). There lies the very sad NFLX and S. (I will save S for another post.)

Clearly on a day when you just had to breathe to be a gaining equity, NFLX wheezed to another decline. But also note the uptick in IV30 on the chart in the lower right. The market is saying this movement is not quite done. That could screw up some call spread sellers if the IV30 continues to tick up even as the stock continues to decline. In general I would rather initiate a position after the name has shown a reversal in IV30. NFLX had a solid 18 point or so range on Monday after the nice rally in the morning and the IV30 is still on an upward arc, clearly jacked from the reversal. The Death of a Momentum Stock is an ugly thing since long holders quickly run out of reasons to own it and there is no real fundamental basis for the lofty value (see Crash of 2000). As a Momentum Name NFLX looks dead but this does not mean the management can’t pull itself out of the current (self-inflicted) tailspin. I am not ready to catch this falling knife yet.

No comments:

Post a Comment