Will Market Volatility cross the “Line of Death”?

With the cash VIX (CBOE Volatility Index) closing below 30 on Monday on a nice rally the question lots of pundits are asking is if we are going to break through to the low 20’s on the “Fear Index”. As for now, 30 seems to be the “Line of Death” (could not help the Gadhafi reference from the mid-80’s) for market volatility as measured by the VIX since the market can’t get past it on the downside. What I would like to do is unpack some of the individual name volatilities that make up a part of the S&P 500 and see if there is a trade or trades that fit the 30 handle inflection on the VIX. Since the VIX seems to bounce off of 30 you want a long Vega trade for the Euro Meltdown threat but also a short Vega trade to help if the Euro scene starts to normalize (we can only hope) and storm through the VIX “Line of Death” like the late, great RR.

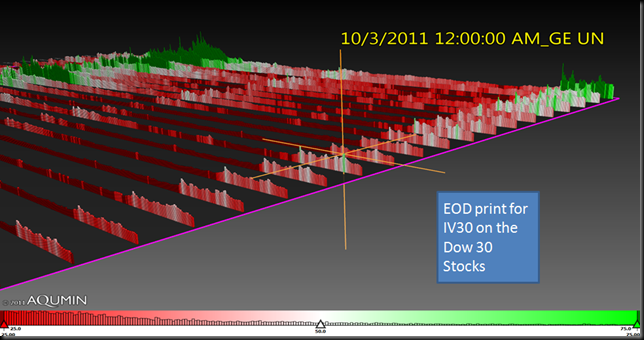

For this job I use AlphaVision™ for Excel and Bloomberg Historical Data. I simply load data into Excel and create a Historical Time Series Landscape in the View Manager (just select the date range and hit “Create”). I am going to pick a relatively small data set of the S&P 500 using the Dow 30 stocks and layout the 30 Day Implied Volatility on the close of each day. The hard thing of course is trying to convey movement in static screenshots. Either way the dark red end of day prints show 30 Day Implied Volatility (IV30) below 25%. IV30 is the 30 day forward price of option implied volatility. Notice as you move to today’s date, the very last print, the colors change over time. That is just a different reading of the30 Day Implied Volatility data (dark red <25%, white= 50%, dark green > 75%). Prior to the USA downgrade, much of the Dow 30 traded at 25% IV30 or less as noted by the rows of dark red buildings. A sure sign of lower volatility is well, lower volatility, and about 1/3 of the Dow is getting back to more quiet levels with a bellwether name like MCD down to 20.35%

Let’s tip toe down the Time Series Landscape (below) until we see some green (50% and above IV30). The idea here is to find a name in the Dow that has the ability for IV30 to “jump”. That first name I see is GE and the current IV30 is down to 29%. GE has a substantial financial component and is now nowhere near the 62% IV30 of a few weeks ago. This probably could go a bit lower before GE interests me from a volatility point of view but it is getting close. I like to know, if the volatility hits the fan again, where that GE juice will go (look at the green spike). Let’s call this the buy side of the volatility equation and mark it. GE just reported earnings.

Now we go to the higher end of the IV30 scale (see below) and we find HPQ. The two higher valued IV30 stocks in the Dow are BAC and AA. Neither really fit with what I want here (BAC is out of category, AA is not rich enough). I want to sell some relatively higher priced IV30 to balance the potential GE volatility purchase somewhere else. 45% IV30 is not too bad for HPQ in an off earnings cycle for a 1 month trade. HPQ is down in the basement as far as stock price with a 5.5 P/E so most likely it would be selling put spreads into the weakness we had on Tuesday. The combination of bidding into IV30 softness by buying puts in GE and selling some controlled downside in HPQ would balance the “Line in the Sand” area we see in the VIX. A big move in implied volatility and the combination should be ok. Maybe even squeak out a few bucks.

Authors Note: Selling and buying options in unrelated issues will cause heavier margin requirements and carries substantial risk. Please consult your investment professional.

No comments:

Post a Comment