The Oil Rout Looks Like It Is Slowing Down

This was a strange day in the market when stocks really lacked a sense of direction. For the most part the tone was down and VIX was up slightly, but the volatility futures actually finished down on the day into the close. There was really a lack of interest more than anything else as the race to NASDAQ 5000 left everyone with an empty feeling.

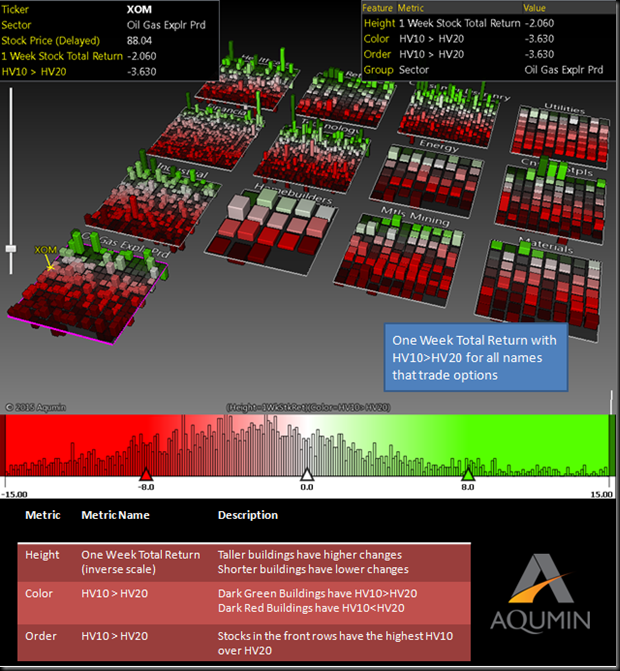

The blighted oil patch seems to have hit a short term bottom. If it isn’t the bottom in prices it is the bottom in realized volatility. Note the OptionVision™ landscape set up where the Oil and Gas producers are in the foreground. Currently they lead the pack in the sector for the biggest average drop in HV10. Granted that was from a very high level, but volatility has to drop for a sector to stabilize, and we are starting to see that.

The sea of red is just 10 day realized volatility trading below the 20 day realized volatility. The oil and gas sector is leading that average decline in realized vol.

I think this group is ripe for selling put spreads and short vega type trades. Oil prices can stay low for a while so pick names that are less leveraged. I have XOM highlighted as a short volatility candidate, but any name in the XLE or XOP ETF’s would do. If you decide to sell a basket of put spreads, working 10% OTM in the individual names, a downside butterfly in the XLE or XOP should hedge.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment