Stocks are in shock

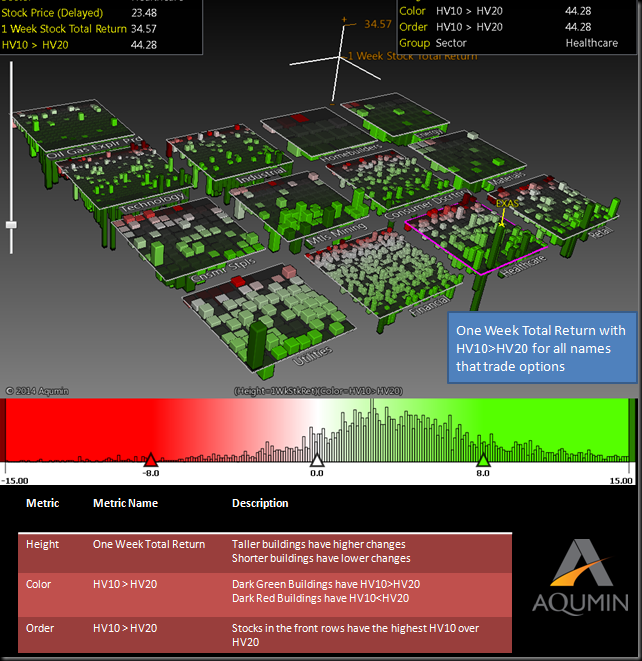

Equities are rolling into the close trying desperately to hold onto the gains they made earlier in the day. Those higher prices are not there but the intraday movement still is. The fact is that realized volatility is at a very high price. Note the OptionVision™ realized volatility landscape set up below.

Roughly 85% of stocks are showing increasing realized volatility. All the green stocks mean that the 10 day realized volatility is higher than the 20 day realized volatility. It is does not happen that often when stocks do this. Red stocks are showing reduced volatility. Usually something big is afoot when there is all this movement. The strange thing about this current selloff is the lack of really bad news. Notice most of the landscape graph is blank meaning those stocks are down for the week. Financials, Utilities and Healthcare are still active just not getting hit like everything else. Oil and Gas explorers are getting it the worst.

This is what stocks look like when the Fed exits. The only thing I can pin a time on is the Fed not raising rates any time soon, scaring the growth story. There will be no more QE even if Europe slows down. Oil prices dropping on supply is hitting a big chunk of the growth in stocks this year and OPEC is staying quiet. That should be good for the consumer. Toss in some bad headline news and there are several factors contributing to the slide but not terribly so. It is best to stay with what is doing ok and not make a big call on the areas that are getting stung.

A trade I like, is take the ETFs that are doing better like XLF, XLV or XLU and look at some upside butterflies in a slightly longer cycle. To dabble in the sector ETFs that are getting hit buy some OTM put time spreads (plus the flies) just in case to generate some decay and more vega if they keep imploding.

EXAS is bucking the entire market trend and might make an interesting long play.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment