Who killed the volatility?

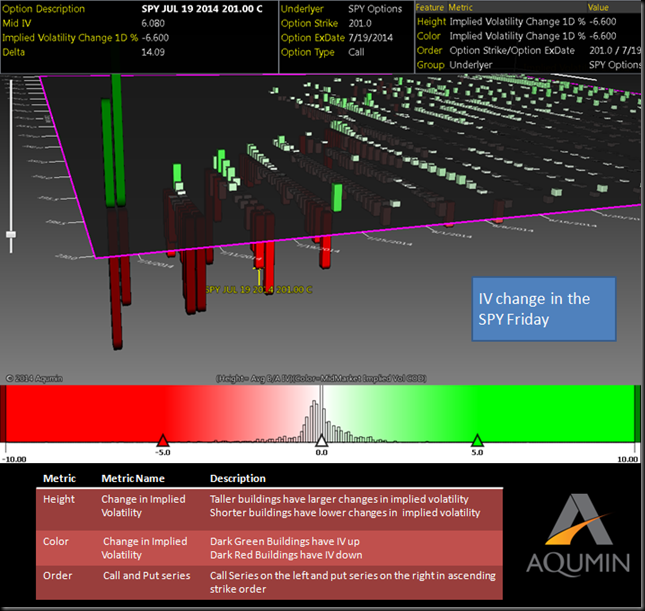

That is the question I am asking myself. I show IV now in the 6 handle for OTM calls in the SPY. This is on top of the SP 500 moving into record territory again. We are moving into the realm where the upside is so cheap no one wants to sell it anymore. Fund managers looking for extra yield are going to start selling calls in stocks if they cannot get the dollars they want in indexes.

That might set up an interesting trade going forward. We will see very high skew for the foreseeable future. Cheap calls and relatively expensive puts might bring buying upside options into the realm of possibility again. One of the great things about bull markets is that traders can buy calls or upside skewed long premium and actually make money. The calls are just very cheap. We might see this for some time.

I think index double calendars are going to work well. Look for at least flat term structure and skew flat to long. The trade should work into the July earning cycle.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment