The Texas Two-Step

The market took another look over the edge today and decided to walk back from the brink. Whatever the uncertainty of the Taper brings, the reality that the Fed is peeling back because the economy is getting better. And as President Clinton, said “It is the economy, stupid.” Recall that early in the week the bid for the downside was perking up. This was the snap on Monday.

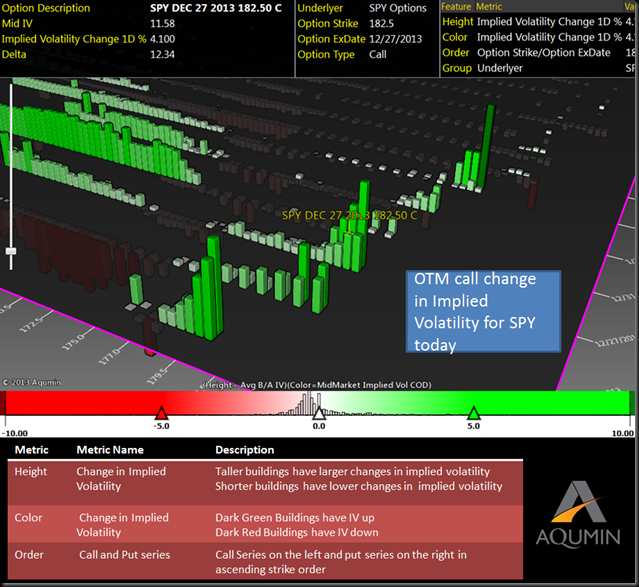

At this point we posted in our blog on Monday that the small bid in skew should lead to higher volatility. With VIX ringing in over 16% today, it certainly did. By using OptionVision™ traders can glimpse into the pit just like a floor trader. The problem with the VIX is that it does not give the whole story and traders should have a granular look at IV. See below, the other end of the curve is starting to move.

Note the bid in the upside skew now as the market came off of its bottom. Much like after the Shutdown the market finds its legs again. I think the result will be similar, but the next few days (until Wednesday at 2pm EDT) will be rocky. The upside broken wing butterflies for even or better should work well. Place the long strike at the near term highs.

Positions in SPY, VIX and its equivalents

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment