The downside skew catches a bid

All that the stock market needed was a return to the status quo. The Fed is still buying debt, the US Government is spending more than they take in and equities fly. Other countries might have worse problems but for now stocks are poised for a giant year.

At the money volatility after 3 days of declines is trading in the single digits. With many of the downside catalysts gone (remember Syria?) the fear of sudden gyration is not at the money anymore. The ATM options are down to 9.99% IV in the Oct 25 cycle for SPY. Last week at this time the IV was near double that.

Yet VIX has found a floor this afternoon after trading much lower. Why? The skew is catching a bid.

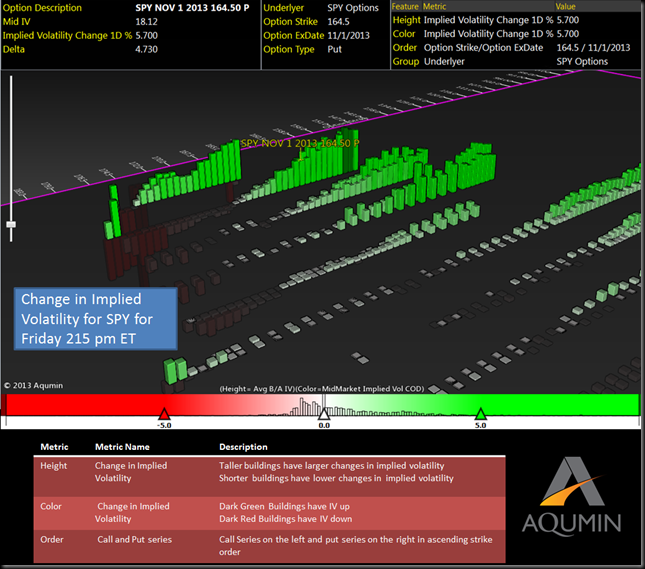

Note on the OptionVision™ landscape how the downside puts are showing higher implied volatility relative to the upside volatilities which have dropped considerably by mid-afternoon. The skew flexing up with the decline in ATM IV should provide some kind of floor for VIX. The big upside, as in the 1% upside moves, should be tougher for a while now that the market does not have a new hole to jump out of.

See Andrew’s 1 hour webinar HERE to follow idea generation using OptionVision.

Alternate link to Video click HERE

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment