Things are shaping up

I don’t want to pooh pooh the rally we have had recently. After 3 years or so of the governments from both sides of the Atlantic trying to “manage” the economy, some of the shackles are starting to break off. Europe does not even make front page news anymore as the Euro is making some short term highs. Mario should thank Ben. Most, if not all, of the economic data has been improving as houses are selling and most businesses are generating decent earnings. With the super low interest rates and giant chunks of liquidity from the Fed the US is set to grow. I don’t know what Ben is going to do with his big balance sheet but I guess he will figure that out. One stumbling block remains and that is level of spending by the US government. The temporary stimulus of 2009 has become a permanent part of the spending landscape. The issue is priced out in the options.

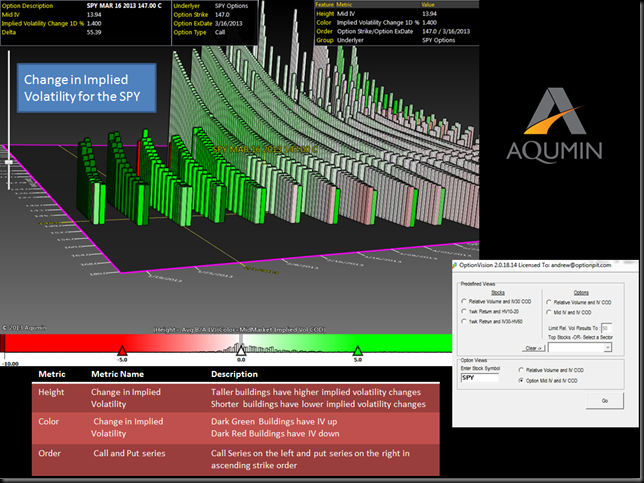

In 2011 much of the volatility market was caught flat footed after the downgrade on the quality of US debt. That ignited a rally in the Treasury paper but shook equity markets down to post crisis lows. The Fiscal Cliff deal helped to bring in some revenue but the government still seems incapable of cutting spending. If you look at my OptionVision™ landscape below, that is reflected in the term structure for the SPY or any of the big indexes really. The front 5 weeks of expiration is much lower than the mid-March cycle. The March and beyond implied volatility towers have higher IV that is not totally explained by normal contango. There was a small rally in very short term volatility in the cycle expiring Jan 25th. Those are the dark green buildings in the second column from the left. That might be enough for a trade.

(Authors note: To see the daily, intraday term structure shift in the big indexes, or any listed product among many market data structures, use the OptionVision™ button noted above.)

On a day the market makes a 5 year high the volatility rallies across the short term. That usually means the market does not buy the rally. The fact that the March did not drop at all means the volatility market does not really believe a debt ceiling deal is ‘close’. For a one week trade, time spread type trades should work (sell the Jan 25 Weeklys and buy March). I don’t think they come up with a real compromise so far from the looming date since our political class is 0 for everything on that score. They head faked us in December so it might be worth betting they head fake us again. My only real question is whether the bond market or Congress will impose spending discipline. I hope it is the latter and hope is not my favorite word when it comes to the markets.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment