When will the skew revert?

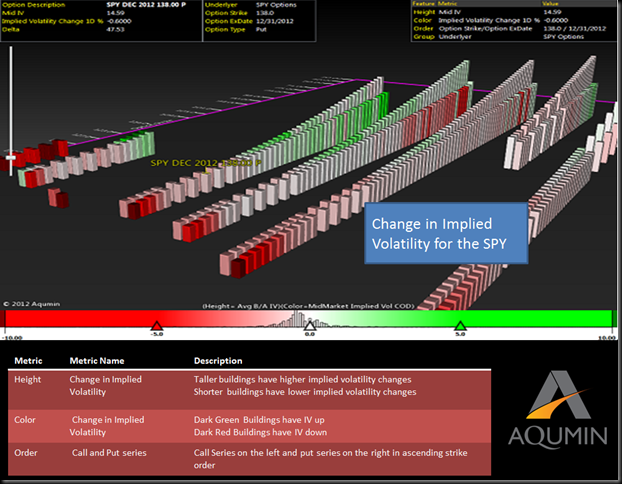

One of the most glaring, unremarked pricing events last week was how flat the SPX skew was on the ride down from 1400 on the index. I actually had the CBOE skew index (SKEW) down around the absolute lows of the year. Essentially the skew in an option product is the degree to which the implied volatility in the out of the money (OTM) options differ from the at the money (ATM) implied volatility. There have been books written and plenty of money spent on divining the moves in the index skew “curve”. If you trade volatility products it behooves you to understand how the curve works. Let’s take a new view from OptionVision™.

The first thing to note is the buildings are higher as the columns move farther away. That is the implied volatility increasing down to the OTM puts. The ITM calls are on the left and provide less reliable readings because the bid/ask spread is wider. The view is showing index skew rising (green) in December relative to the ATM. Most of the Dec put protection was sold out last week and the curve is climbing in its natural fashion. Note the later terms just after the Dec ordinaries, the skew is still declining a touch relative to the ATM. Darker red is a steeper decline. Some Jan downside put sellers are still active.

The reason the later months are still lower is that puts are still for sale. The news says progress and paper is unloading their puts. For the market that is a healthier sign for some higher prices short term. Having paper start to take profits in long put positions I think is slightly bullish. Now we need the politicians to tie up their ends.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment