Are the AAPL options telling us something?

The market has settled into a pattern of movement lately of a little down followed by a little up. Most of the index skew has been steep lately so market volatility seems expensive relative to the actual moves we are getting. Not so really in the earnings stocks. The moves right now have been of pretty good size in the bigger names (IBM comes to mind). I thought it might be a good time to examine some relative skew in another big name.

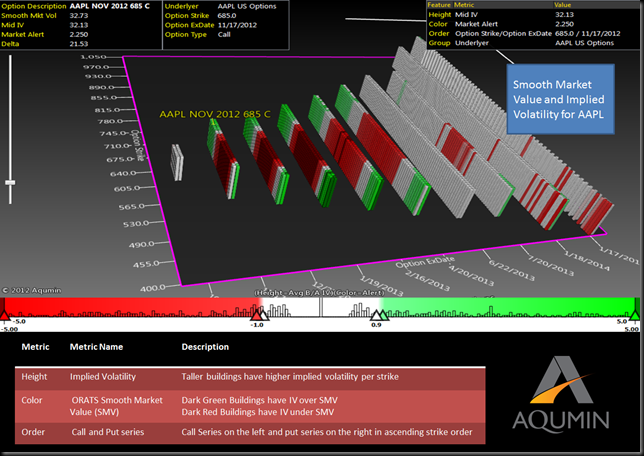

AAPL is closing in on earnings next week and the implied volatility is relatively elevated. What looks a little different than normal is how the skew relates in all the months. Normally, AAPL has a bit more elevated IV in the OTM options due to all of the customer interest. Early this week, right now the upside is trading relatively cheap. Note all the green strikes below in my OptionVision™ landscape. That indicates that the OTM options are a little cheaper relative to the ATM options. Most likely the move down from 700 has something to do with that. The red options below show that the ATM options are more expensive than their OTM counter parts.

What might work as a trade into earnings ? If the upside is trading cheaper, an OTM butterfly position with about 40-50 points between the strikes would be a nice way to buy some discounted deltas into earnings. Normally when the ATMs are a bit more expensive, paper is planning on a big move. For the AAPL heads out there, this might be a nice ride through the cycle and you don’t have to pay as much as usual.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

No comments:

Post a Comment