Fill up the tank or buy a Coke?

As we sit going into the Italian Bond auctions next week, the market is going nowhere fast. The reality of constant intervention promises and no real action is finally dawning on the equity markets. No action, no rally seems to be the sentiment. That does not mean there is nothing going on in other places. Take the drought we have seen this summer as an example.

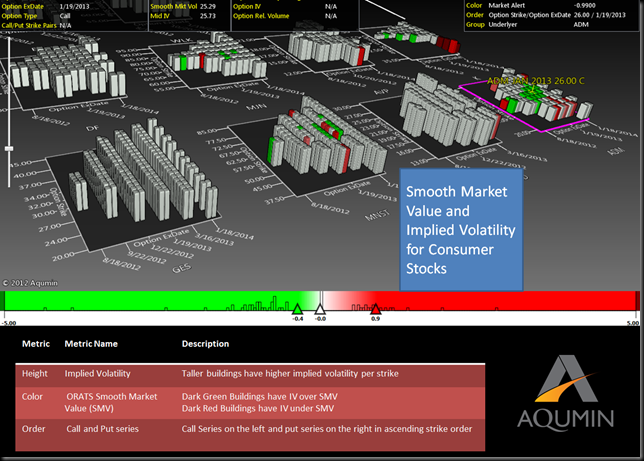

I have the Option Vision™ screen from Aqumin and ORATS below showing the current Implied Volatilities relative to the ORATS Smooth Volatility Valve (SMV). This shows when a stock skew (relationship of out of the money calls and puts) is out of kilter from a historical norm. The close up below is for a stock I have been watching, ADM. The green buildings are showing higher IV to norms at the money.

If you zoom out you will notice how ADM stacks up to other names in the sector. Note MNST (the beverage maker) is getting a bit of a volatility squeeze too on the skew with a pending investigation.

I think the market is looking at ADM with a lot of corn going to ethanol and the other bunch going to corn syrup (think KO). The problem is that ADM is stuck in the middle of the $8 per bushel corn rise and is getting squeezed. As long as the options stay bid, I think more downside is in the cards for the big ag processor.

Note: Alerts could indicate an option that has been traded and has moved away from the normal volatility relationships as defined by the smooth fit. Alerts can also indicate groups of options that are trading off the curve for other market reasons. For example, if the at-the-money options are trading lower than the smooth and the out-of-money are trading higher than the smooth this may indicate that the market is expecting lower volatility in the coming days but not in the longer term where the outs may give protection.

Read more from Andrew at Option Pit

No comments:

Post a Comment