Sometimes I yearn for the good old days. I think I am old enough now to look back 15 years or so and fondly remember when a crisis or bubble had a beginning, middle and an end. The USA invented Brady

Bonds for Latin American debt in the 1980’s, fixed that. The Mexican Peso crisis in the mid 1990’s was mostly a collapse in the price of TMX (at the time one of the biggest traders on the CBOE) and Treasury Secretary Rubin (he handled the 1990’s flare ups rather well) rode to the rescue on the currency with guarantees. Brazil had inflation issues but moved to fix them with substantial policy changes. We had a great Biotech Equity Bubble in 1991-1993 when no one would buy a stock that made real money. The Asian Currency crisis in the late 1990’s help set up the current prosperity of today in that region. It was a good lesson that you don’t want to borrow too much in another currency and should make subsequent policy adjustments accordingly. The point for our current market volatility is that still, a year or so in, there are really no substantial policy adjustments in the Euro Zone (PIG austerity?) that market participants are buying. Let’s see how that play’s out in the market’s underlying volatility right now.

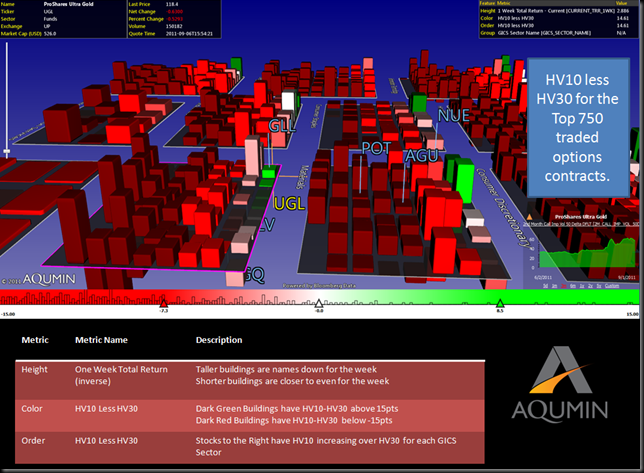

One thing I like doing is using simple arithmetic setups with different volatility measures to get a sense of what is happening behind the bigger indicators. In the AlphaVision™ Landscape below running on the Bloomberg Terminal I have set up a landscape using 10 Day Historical Volatility (HV10) minus the 30 Day Historical Volatility (HV30). If a name is moving more over the last 10 days than the last 30 days it will show up in green on the right of each GICS Sector. Building height is the total return for the week (up is negative in this case) when I pulled up this 3D quote screen Tuesday afternoon.

The first thing you notice is the Landscape is mostly red for the 750 or so names that trade 500 call option contracts or more. This means that the HV10 is less than the HV30 for most of the active listed names that trade options. As I commented last week, the crisis is slowing down in terms of Historic or Realized volatility recently but still near the peak of last year. What surprised me was that so few names had accelerating HV10 yesterday and barely a handful had HV10 15pts higher than HV30 (which is a level through observation I like to note). For the ETF group, both the UGL (ProShares Ultra Gold) and the GLL (ProShares UltraShort Gold) had rocketing levels and were leading ETF’S and very near 15pts higher. If I had a hard screen at 15pts, I would have missed these names using traditional screening techniques.

Now what does this mean? With the two levered Gold ETF’s leading the uptick in HV10 money is concentrating in these underlying contracts even more, pushing the Realized Volatility levels around. The gold trade is even more so the on again, off again way to manage risk for the average investor and the underlying volatilities are starting to show it. Euro Crisis solved gold in the tank, Euro Crisis on more of the same and higher with more Realized Volatility. Tough to believe we have turned gold into an early 1990’s Biotech stock but it is starting to trade that way. Almost 20 years later, same crazy activity but different names. Who knew?

No comments:

Post a Comment