The Avon lady is calling

A dead day is a dead day. And today the market is living up to its low volatility number by putting in a .14% drop. That is hardly enough to register on the VIX-o-meter. Any little blip in activity stands out more on a day like today.

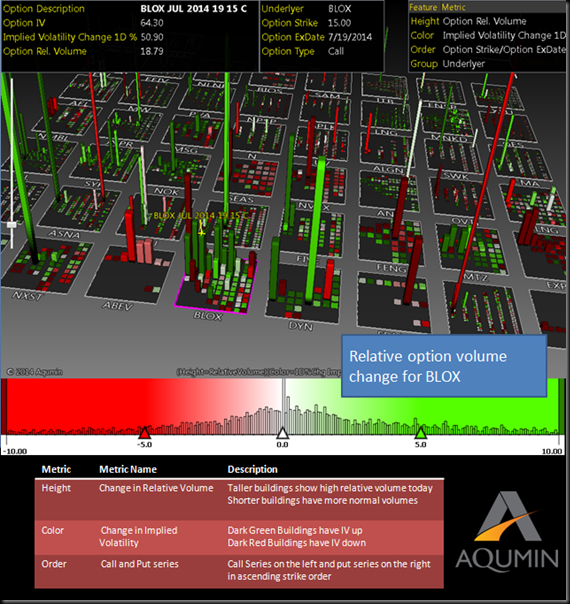

Note the activity in the AVP Aug 13 puts on the OptionVision™ landscape below. Paper bought a big block of puts and most likely this was tied to stock. As we move forward earnings are usually on the 1 day of August in AVP. This is pretty early in the earnings cycle to buy a big chunk of juice.

AVP has not done much lately. A couple years ago they were the object of desire for COTY in a buyout attempt. The level of the buyout was much higher than AVP is now. I don’t think AVP makes a bad buy write here on the Aug 8 Weekly 14.5 calls. It should yield around 5% and it puts you into AVP near the lows of the year. Of course if COTY comes around again you don’t get the big dough for the takeout.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit