Peeled back in Apple

The market had a nice reversal yesterday. Over the last couple of days AAPL has generally been leading the market out of the Greece induced doldrums. I don’t think we get into any big rally mode until there is some clarity on the Euro issue (remember the 1st quarter rally?) so for now, market players have to take what they can get.

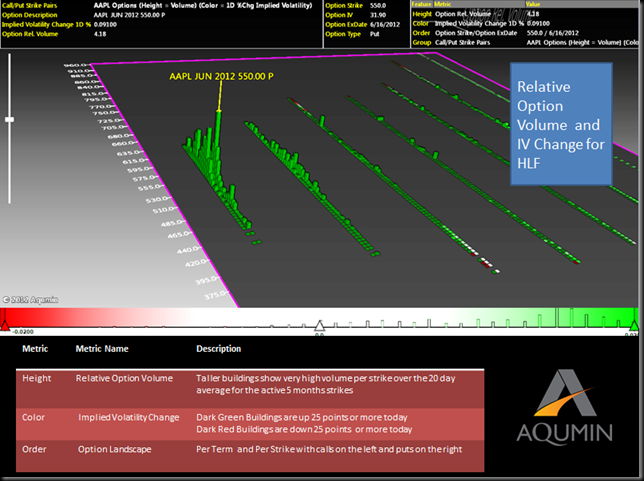

Look at the strike by strike activity yesterday in AAPL. In the morning, paper was piling into the name in June. Note the high relative volume (spiky green strikes) and pop in volatility when things looked extra ugly in the morning. The OptionVision Landscape gives a nice sense to the bid in volatility in the morning. Will it hold up?

Now as the day progressed and AAPL started to catch a slight bid the upside volatility started to peel back a bit. Note the upside strikes in the OptionVision Landscape below. The red buildings are showing the hints of implied volatility coming in and this was a good signal to start selling the IV in general in June. While the more ATM contract stayed bid 2% above their opening value, they did drop from about 4% over. Either way, the bid in volatility coming off was a good signal to sell it.

Watching the volatility flow in action helps create positions. With the higher IV, AAPL is setting up mostly for butterfly type trades and catching a downturn in IV helps add some positive p/l in a hurry.

Read more from Andrew at Option Pit

No comments:

Post a Comment